All Things Crypto

Note: This post is too long to be all on email, so it is best to open it in your browser

Today, I want to cover all things crypto that I am seeing in the market. These are broken down in the following sections:

Macro

BTC

NFTs

ETH

SOL

Other Layer 1s (Avalanche, Pokadot, Cardano, etc)

The Super Cycle Theory

My 30,000 Foot View of Cryptocurrencies

There is some overlap between sections but it is meant to be comprehensive in each section.

TLDR:

The Cryptocurrency market is growing exponentially with mass adoption through NFTs and the market is rewarding layer 1s that have this functionality.

BTC is still driving the entire market and is continuing the 4 year cycle.

But we should watch out for layer 1s decoupling from the bitcoin cycles as adoption accelerates.

Macro View

Cryptocurrencies are being adopted at an insane rate

Active Wallets for Ethereum and Bitcoin. In 4 years, Ethereum went from 0 to ~600k active wallets

Daily Average Transaction Value for Ethereum and Bitcoin has skyrocketed over the past several years (Ethereum broke $20 billion in May 2021)

Twitter adopting bitcoin tipping

And they are looking into integrating NFTs for Twitter profile pictures

El Salvador has made bitcoin legal tender

Zoom out on bitcoin price

Though we have reasons to doubt these returns will continue over the next year…

Federal Reserve tightening. The market is skittish on how tapering will impact the market.

Less liquidity is bad for all markets broadly?

SEC and Gensler are seeking stronger regulations on the cryptocurrency space, labeling them as securities. Though , this is long term bullish as it allows for more adoption from institutions

And also we have Senator Toomey pushing Gensler on clarity

China Ban causing fears in the market…

Though think about technologies China has banned…

And finally…

Bitcoin

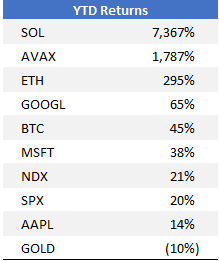

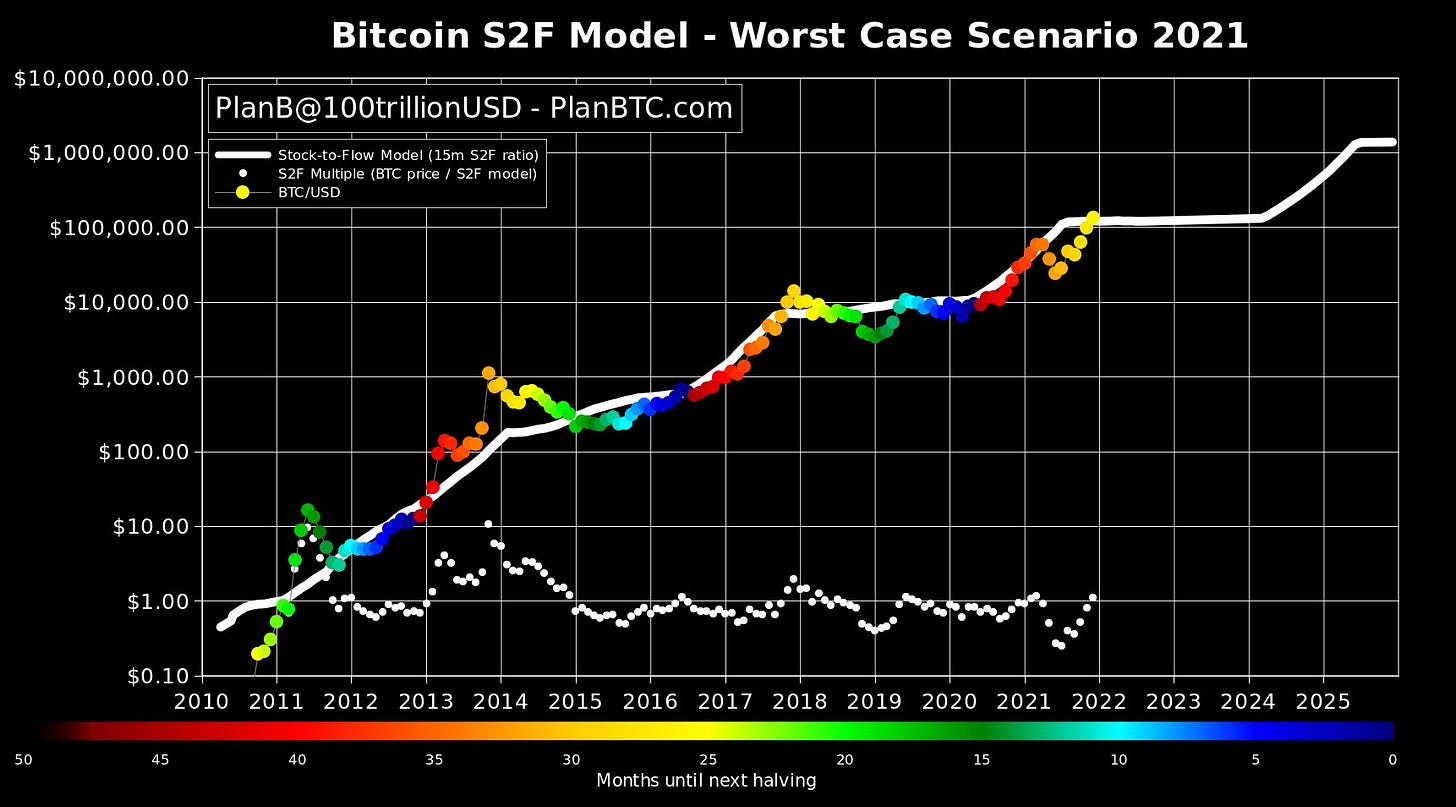

Bitcoin is continuing to act similar to previous cycles and is still following the stock-to-flow model fairly well (popularized by PlanB)

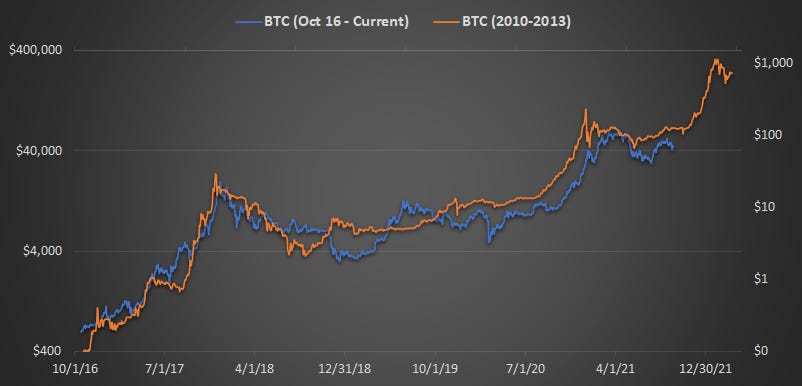

Bitcoin’s price from 2016-current is mapping shockingly well to 2010-2013

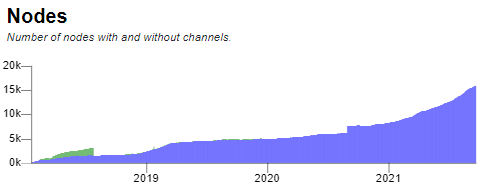

This past week, Twitter integrated bitcoin tipping for twitter accounts, running off the bitcoin lightning network

The lightning network is a layer 2 protocol built on top of bitcoin (layer 1) and capacity and number of nodes on lightning have skyrocketed

4 year cycle in more detail but same story

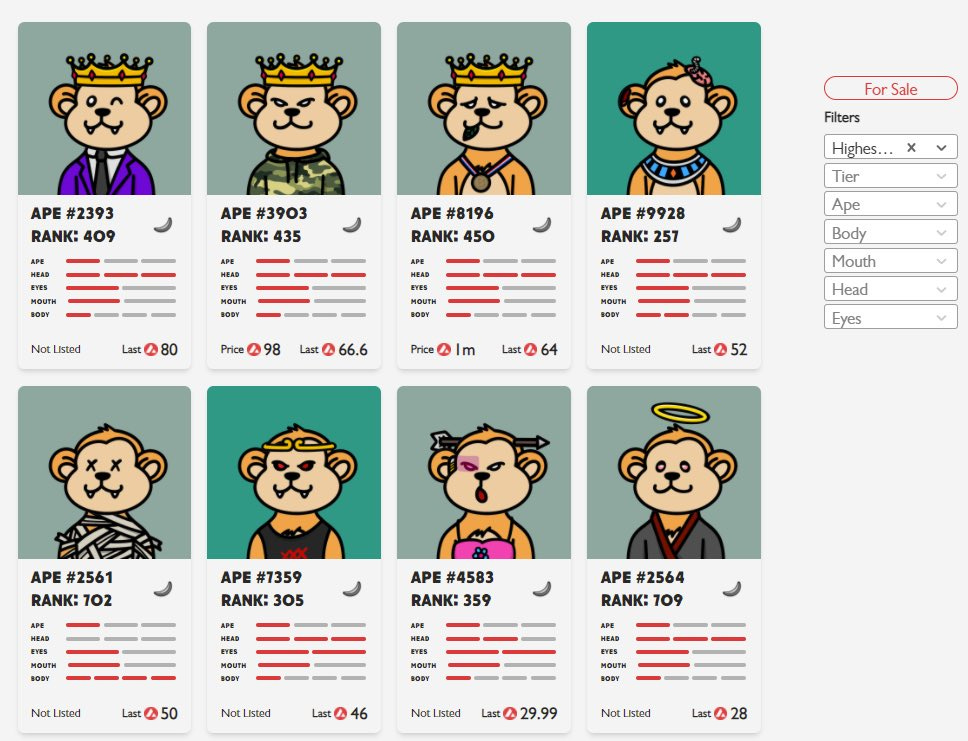

NFTs

NFTs are showing the power of an idea and movement among a group of people with a similar ideology or passion. And NFTs becoming a symbol by which these groups identify themselves in the digital world.

It may be hard to see the value here but imagine being buying digital memorabilia of your favorite sports team vs a team you have never heard of. I doubt you would be as price sensitive for something that you identify with.

And these NFT communities are lively! Most notably is the Bored Ape Yacht Club. They have a roadmap and currently they go for 39 ETH minimum (~$120k). To be a part of this, you need to own a Bored Ape NFT.

But in general, the market is super active and even now twitter is looking into integrating NFTs with Twitter profile pictures. A great move as many on Crypto Twitter have NFTs as their profile picture and they have a strong emotional connection to some of their NFTs

OpenSea, the largest NFT marketplace, has seen active users go from ~400 in September 2020 to ~30,000 today

Most valuable NFT collections on ETH are Crypto Punks, Bored Apes, and Fidenzas though I am sure I am missing a lot more big ones. Below is top collections by volume (CryptoPunks had 135k ETH (~$400mm) in volume the past 30 days!)

Axie Infinity is a play-to-earn game built on top of the Ethereum network with the largest discord globally with 800k members. It has sold the most ETH NFTs of anyone with ~64k in sales

And new collections are coming out as a community supporting a cause. One is supporting Mental Health Awareness (Blankface)

Snoop Dogg is getting in the NFT game too. Who said NFT’s don’t have utility…

But all this activity ignores the biggest NFT news which is the NFT madness on Solana. NFTs were not even possible last year for Solana but they started over the past several months. Total market cap of $360mm!

And look at the total value for some of these collections! Degen Apes, Solana Monkey Business (SMB), Frakt, Aurory, Galactic Geckos, and SolPunks near the top. Galactic Geickos came out last week and already have a value of $21mm.

A look at these purchases by a London Hedge fund called Moonrock Capital!

In SOL, so many NFTs are coming out that it hard to keep track, but here is a quick list of others not mentioned in the top 10 of Solanalysis.

Bold Badgers, Fancy Frenchies, Crypto Cavemen, SolanaDogeNFTs, Sneks, Frat Pandas, and so many more.

These NFTs are doing airdrops, the communities are bonding, and some are even building games (Aurory). And if you jump in the discords, you’ll see some NFT communities thriving, where the community builds on top of what the initial team has done.

And some NFTs are getting a huge following. Galatic Geickos has a huge following and large crypto twitter accounts are or were repping them, including Penthoshi, TraderKoz, CryptoKaleo, CryptoChimp, etc.

There are even NFTs on AVAX, with much less transaction than SOL but nonetheless AVAX is extremely promising. One being AVAX Apes.

And Cardano has just completed its Alonozo hard fork to add smart contract capability. And NFTs are coming now on Cardano. CNFT is the first Cardano NFT marketplace.

Oh and now there are NFTs on Internet Computer called ICP Punks here

NFTs are a major driving force behind layer 1 adoption and demand.

ETH

Number of Ethereum active wallets is growing rapidly

Total value locked in DeFi protocols on Ethereum hit all time highs recently. Currently at $124bn

The number of daily transactions on Ethereum broke 700k recently (30 average)

And finally ETH is BTC 2017. this is one of my favorite charts by Raoul Pal

And as mentioned in the NFT sub-thread, Ethereum NFTs are a huge driving force behind mass adoption and growth on Ethereum.

But to give you a taste, OpenSea, the largest NFT marketplace, has seen active users go from ~400 in September 2020 to ~30,000 today

For all things Ethereum NFTs, see the NFT section for more details.

SOL

Adoption of Solana is hitting critical mass. A popular Solana wallet, Phantom, has been live 6 months and already has 400k weekly active users

And the entire Solana ecosystem. The point is that there is a lot in this picture

Total Value Locked in DeFi protocols on Solana are nearing ~$9bn as of this writing. Exponential growth anyone?

We can now bridge between Solana and Ethereum meaning Solana NFTs can now be sold on OpenSea

There is a metaverse game called Star Atlas being built on Solana

Serum is a decentralized limit order book protocol built on Solana, backed by firms like Jump Trading and FTX

And as mentioned in the NFT sub-thread, Solana NFTs are gaining huge traction. For all things Solana NFTs, see the NFT section for more details.

And even more in depth, check out this thread from Michael Rinko

Other Layer 1s

There are other layer 1s being adopted. Some layers 1s include:

Avalanche

Polkadot

Cardano

And so many more that are in development or early stages

Avalanche (AVAX)

Another smart contract platform, AVAX has gone from 0 to ~$4bn in TVL in 6 months

Polkadot (DOT)

DOT has coming out what they call Parachains and they just had their first parachain auction

On top of the DOT network is a company called Enjin, a platform providing a simple interface for the average person to make NFTs and easily create utility behind them. A recent podcast they were interviewed in:

Cardano (ADA)

ADA just went live with smart contracts on September 12 (Alonzo fork)

And now NFTs are on the Cardano network via CNFT.IO

And DeFi is coming to Cardano too

So much going on in just the layer 1s of the cryptocurrency space, it is nearly impossible to catch up

The Super Cycle Theory

Many of been hearing the idea of the super cycle for cryptocurrencies and I want to give my take on this idea.

But first, let me define what the super cycle means to me.

It when cryptocurrencies including bitcoin break away from the historic bitcoin cycles which have coincided with bitcoin halvings.

They start to go up or down based on their own fundamentals, not of what bitcoin does.

It is abundantly clear these cryptocurrencies such as ETH, SOL, and ADA have yet to hit escape velocity.

For example, when bitcoin crashed in May 2021, all other cryptocurrencies still crashed and crashed way further than bitcoin.

Assets are correlated to it makes sense for all crypto to crash but in a super cycle, by definition, some should crash less based on their own fundamentals.

That isn’t to say we aren’t in the early innings of a super cycle, but it isn’t clear yet.

Many say because historic bitcoin cycles are so well known in the crypto community, we shouldn’t expect to see them anymore, but…

But there is real potential that we are in the early stages of a super cycle.

El Salvador just made bitcoin legal tender.

Ethereum, Solana, and other smart contract platforms are gaining traction and we are just beginning to see real utility on these platforms via DeFi and NFTs.

So are cryptocurrencies decoupling from historic bitcoin cycles? Not yet but it is something we should be watching for.

My 30,000 Foot View of Cryptocurrencies

Final Thoughts

I am sure I missed so much, but that is almost the point. There is so much going on.

With all going on, how can you not be long when BTC and crypto are in the spotlight around the world. Mass adoption is here and demand is outstripping supply.

I’ll leave it here.

Authored by Derman Capital (Twitter)